What Canadian Lenders Look for Beyond Credit Scores

Credit scores often dominate financial discussions, yet Canadian lenders rarely rely on that single number alone. Approval decisions usually depend on a wider review of how a person handles money over time. This broader review helps lenders judge repayment ability within Canada’s regulatory structure, which differs by province and reflects local economic realities. Borrowers exploring short-term solutions may notice that a trusted payday loan provider also looks past the score to understand current financial behaviour. From income flow to daily banking activity, lenders search for practical signals that suggest stability. This article explains five key factors Canadian lenders commonly assess, offering clarity for readers who want to understand how approval decisions are shaped without leaning on buzz-heavy explanations.

Income Consistency

Income consistency sits near the top of most lender checklists. Canadian lenders look for patterns rather than impressive figures. Regular pay deposits show predictability, even if the amount is moderate. Applicants with weekly, biweekly, or monthly income that arrives on schedule often appear less risky than those with irregular spikes. Self-employed Canadians are not excluded, but they usually need to show income history through tax filings, invoices, or contracts. In provinces where seasonal work is common, such as parts of Atlantic Canada or Northern regions, lenders may review income across longer periods to see how applicants manage quieter months. Stability over time often matters more than recent increases.

Existing Financial Commitments

Another major factor is how much of your income already goes toward obligations. Canadian lenders examine outstanding balances on credit cards, vehicle financing, student loans, and other commitments. The goal is to see how much room remains after monthly expenses. A borrower with manageable obligations may appear stronger than someone earning more but carrying heavy monthly payments. This review reflects Canada’s consumer protection standards, which aim to reduce overextension. Lenders also note whether payments are made on time. Consistent repayment history suggests control, while frequent missed payments raise concerns regardless of score level.

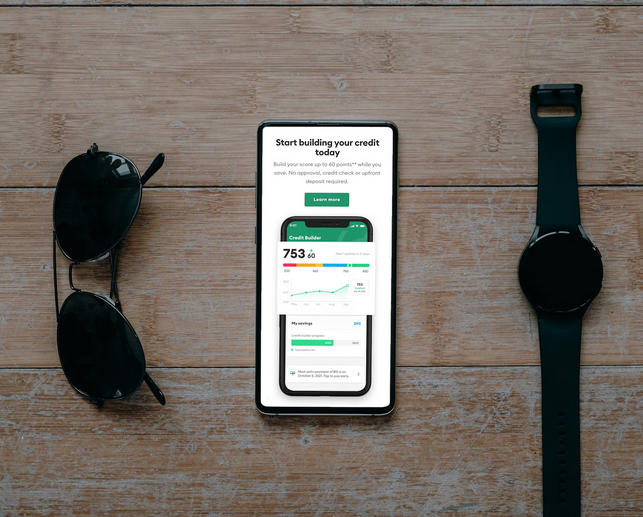

Banking Behaviour

Day-to-day banking activity provides insight into financial habits. Lenders often review chequing account history to see how funds are handled. Steady balances suggest planning, while repeated overdrafts can signal pressure. Canadian lenders may also look at how long an account has been active. Long-standing accounts show continuity, whereas frequent changes may prompt questions. Transaction patterns, such as regular bill payments and limited cash advances, help paint a clearer picture. For some alternative lenders, recent banking behaviour carries more weight than older credit events, especially for applicants working to rebuild their financial standing.

Employment History and Work Type

Employment history influences how lenders interpret income reliability. Long-term employment with one employer often appears favourable, yet it is not the only acceptable route. Contract workers, freelancers, and tradespeople are common across Canada, particularly in urban centres like Toronto, Vancouver, and Calgary. Lenders focus on continuity rather than job titles. Frequent job changes may still work if income flow remains steady. In smaller towns or resource-based regions, lenders may consider local employment cycles when reviewing applications. Clear documentation helps support the employment story and reduces uncertainty during assessment.

Location and Cost Factors

Where you live shapes how lenders view financial obligations. Housing, transportation, and utility costs vary widely across Canada. A rent amount that seems high in one province may be average in another. Lenders account for these differences rather than applying a single national standard. Provincial regulations also affect lending practices, especially for short-term products. Approval criteria in Ontario may differ from those in Alberta or British Columbia. By factoring in location, lenders aim to judge affordability within a realistic local context rather than relying on generalized assumptions.

Canadian lenders look beyond credit scores to understand how people manage money in real life. Income patterns, existing commitments, banking habits, employment history, and location all shape approval decisions. By understanding these five factors, borrowers gain clearer expectations and can prepare more effectively before applying. A broader view encourages informed choices and smoother experiences within Canada’s lending environment.…

Before jumping into higher-risk assets, ensure you have access to quick cash for emergencies. A high-yield savings account offers better interest rates than traditional bank accounts, keeping your funds

Before jumping into higher-risk assets, ensure you have access to quick cash for emergencies. A high-yield savings account offers better interest rates than traditional bank accounts, keeping your funds

Controlling your debt is a key habit leading to financial freedom. One of the primary reasons people struggle with their finances is because they have accumulated too much debt. If you want to achieve financial freedom, then it's important to get your debt under control. The first step to controlling your debt is to take stock of all outstanding loans and credit card balances. Once you know how much money you owe, create a plan to start paying off these debts as soon as possible.

Controlling your debt is a key habit leading to financial freedom. One of the primary reasons people struggle with their finances is because they have accumulated too much debt. If you want to achieve financial freedom, then it's important to get your debt under control. The first step to controlling your debt is to take stock of all outstanding loans and credit card balances. Once you know how much money you owe, create a plan to start paying off these debts as soon as possible.

Building an emergency fund is the most important habit to develop for

Building an emergency fund is the most important habit to develop for

One of the quickest ways to fix your credit problems is to hire a credit repair company. However, it is important that you choose from the best credit fixing companies. Credit repair companies specialize in helping people improve their credit scores. They will work with you to remove negative items from your credit report, such as late payments, collections, and charge-offs. This can help to improve your credit score quickly.

One of the quickest ways to fix your credit problems is to hire a credit repair company. However, it is important that you choose from the best credit fixing companies. Credit repair companies specialize in helping people improve their credit scores. They will work with you to remove negative items from your credit report, such as late payments, collections, and charge-offs. This can help to improve your credit score quickly.

Personal loans are one of the most common types of

Personal loans are one of the most common types of

Making a budget is one of the most important things to stay out of debt. You need to know how much money you have coming in and going out each month. Once you know this, you can make adjustments to ensure that your spending does not exceed your income. Many people think that they do not need a budget because they do not have a lot of expenses. However, even if you do not have many expenses, it is still essential to know where your money is going. This will help you make

Making a budget is one of the most important things to stay out of debt. You need to know how much money you have coming in and going out each month. Once you know this, you can make adjustments to ensure that your spending does not exceed your income. Many people think that they do not need a budget because they do not have a lot of expenses. However, even if you do not have many expenses, it is still essential to know where your money is going. This will help you make  It is also essential to have a savings account that you can rely on in an emergency. This will help you avoid using credit cards or taking out loans when something unexpected comes up. Many people forget to save money, but it is one of the most important things you can do to stay out of debt. You need to set aside some money in your savings account every payday. This will help you in the long run.

It is also essential to have a savings account that you can rely on in an emergency. This will help you avoid using credit cards or taking out loans when something unexpected comes up. Many people forget to save money, but it is one of the most important things you can do to stay out of debt. You need to set aside some money in your savings account every payday. This will help you in the long run. The last reason people find themselves in debt is that they overspend. It is essential to be mindful of your spending and only purchase what you can afford. Use cash or a debit card instead of credit cards to avoid temptation. This is very important because credit cards can be easy to max out. Many people, including celebrities, have filed for bankruptcy because of credit card debt, which is why it's essential to be mindful of your spending and only purchase what you can afford.

The last reason people find themselves in debt is that they overspend. It is essential to be mindful of your spending and only purchase what you can afford. Use cash or a debit card instead of credit cards to avoid temptation. This is very important because credit cards can be easy to max out. Many people, including celebrities, have filed for bankruptcy because of credit card debt, which is why it's essential to be mindful of your spending and only purchase what you can afford.

While budgeting and insurance are essential, you should also make sure your money works. One way to do this is to invest in a suitable investment. It may seem like a daunting task, but plenty of resources are available to help you make the best decision for your money. Many millennials prefer Bitcoin or other crypto coins as their investment, but gold and real estate are still solid options. You can also consult with a financial advisor to determine what investment is best for you.

While budgeting and insurance are essential, you should also make sure your money works. One way to do this is to invest in a suitable investment. It may seem like a daunting task, but plenty of resources are available to help you make the best decision for your money. Many millennials prefer Bitcoin or other crypto coins as their investment, but gold and real estate are still solid options. You can also consult with a financial advisor to determine what investment is best for you. Last but not least, you should always make sure to put some money into savings. It will help you in case of an unexpected expense or emergency. You may also consider using a portion of your savings to invest in something like a home or retirement fund. Whatever you do, make sure that you have a plan for your savings to make the most of your money.

Last but not least, you should always make sure to put some money into savings. It will help you in case of an unexpected expense or emergency. You may also consider using a portion of your savings to invest in something like a home or retirement fund. Whatever you do, make sure that you have a plan for your savings to make the most of your money.

One of the safest investments for beginners is a high-yield savings account. These accounts offer a relatively low rate of return, but your money is secure and you can access it at any time. Additionally, there are no fees associated with high-yield savings accounts, so they are an excellent option for people starting in the investment world. Another benefit of high-yield savings accounts is that they are easy to set up and manage.

One of the safest investments for beginners is a high-yield savings account. These accounts offer a relatively low rate of return, but your money is secure and you can access it at any time. Additionally, there are no fees associated with high-yield savings accounts, so they are an excellent option for people starting in the investment world. Another benefit of high-yield savings accounts is that they are easy to set up and manage. Preferred stocks are a type of security that offer investors both income and the potential for capital appreciation. Preferred stocks are often seen as a hybrid between common stocks and bonds, and they can be attractive to investors looking for stability and income. One of the benefits of owning preferred stocks is that you will typically receive a regular dividend payment.

Preferred stocks are a type of security that offer investors both income and the potential for capital appreciation. Preferred stocks are often seen as a hybrid between common stocks and bonds, and they can be attractive to investors looking for stability and income. One of the benefits of owning preferred stocks is that you will typically receive a regular dividend payment.

The first thing that professional credit repair services will do is review your credit reports for any derogatory marks. These are items on your credit report that can lower your scores, such as late payments, collections, charge-offs, and more.

The first thing that professional credit repair services will do is review your credit reports for any derogatory marks. These are items on your credit report that can lower your scores, such as late payments, collections, charge-offs, and more. If you have debt collectors calling you, it can be very stressful. Professional credit repair services will send ceasing letters to them on your behalf. It is a formal notice that tells them to stop contacting you. Once they receive the letter, they cannot call you again. It can give you some peace of mind and help improve your credit score.

If you have debt collectors calling you, it can be very stressful. Professional credit repair services will send ceasing letters to them on your behalf. It is a formal notice that tells them to stop contacting you. Once they receive the letter, they cannot call you again. It can give you some peace of mind and help improve your credit score.

When choosing a company, the first thing you should look for is its history. If they've been around for more than five years, they're likely not going anymore soon!

When choosing a company, the first thing you should look for is its history. If they've been around for more than five years, they're likely not going anymore soon! Not all debt consolidation companies are created equal, and some may be outright scams. So it's essential to do your research before trusting anyone with your financial future.

Not all debt consolidation companies are created equal, and some may be outright scams. So it's essential to do your research before trusting anyone with your financial future. Another vital thing to consider when choosing a debt consolidation company is its fees. Some may have a one-time fee, while others may charge monthly or annual fees. Make sure you understand these and how they will impact your overall costs.

Another vital thing to consider when choosing a debt consolidation company is its fees. Some may have a one-time fee, while others may charge monthly or annual fees. Make sure you understand these and how they will impact your overall costs.