DIY Credit Repair: How to Improve Your Credit Score Without a Professional

Are you tired of feeling trapped by your credit score? You're not alone. Many people find themselves in a similar situation, frustrated with their financial standing and unsure about how to fix it. The good news is that improving your credit score doesn't have to involve hiring expensive professionals or complex strategies.

With a little dedication and some do-it-yourself tactics, you can take control of your credit health right from the comfort of your home. Whether you're looking to buy a house, secure a loan, or gain more financial freedom, understanding how to repair your credit on your own is crucial. Let's dive into practical steps that anyone can follow to boost their credit score without breaking the bank.

Check Your Credit Report Regularly

Checking your credit report regularly is known to be a vital first step in improving your credit score. It's like giving your financial health a routine check-up. You can uncover errors or discrepancies that may be dragging down your score. You're entitled to one free credit report each year from the major reporting agencies—Equifax, Experian, and TransUnion. Take advantage of this opportunity. Review the details carefully for inaccuracies, such as incorrect balances or unfamiliar accounts. If you spot an error, dispute it promptly. This can result in a quicker boost to your score than you might expect.

Pay Your Bills on Time

Paying your bills on time is one of the simplest yet most effective ways to boost your credit score. Each timely payment signals to lenders that you're a responsible borrower. This consistency builds trust over time. Many people overlook how late payments can impact their credit scores. Even just a few days can make a difference, and those missed deadlines accumulate quickly. Setting up reminders or automatic payments can help you stay on track and avoid any hiccups. Consider using budgeting tools to manage your finances better.

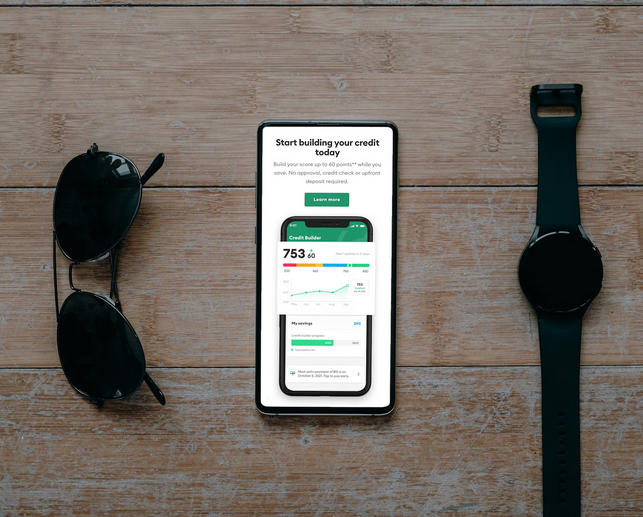

Reduce Credit Card Balances

High credit card balances can weigh heavily on your credit score. The lower your balance, the better it reflects on your financial health. Start by creating a budget that prioritizes paying down those debts. Focus on high-interest cards first to save money over time. Even small payments can make a difference. Consider methods like the snowball approach—paying off smaller balances first—or the avalanche method, which targets higher interest rates. Both strategies create momentum and motivate you to keep going.

Avoid Opening New Credit Accounts

Opening new credit accounts may be tempting, especially during a sale or when a promotional offer arises. However, each application triggers a hard inquiry on your credit report. These inquiries can slightly lower your score. Moreover, having too many open accounts can signal risk to lenders. They may perceive you as financially unstable or overly reliant on credit. This perception could hinder your chances of securing loans in the future. Instead of adding more debt, focus on managing existing accounts wisely. Consider using the available credit you have effectively instead of seeking out new lines of credit that could complicate your financial situation.

Improving your credit score independently is entirely possible with dedication and smart strategies. Regularly checking your credit report lets you stay informed about any changes or discrepancies. This awareness allows you to address issues promptly. Timely bill payments are essential; they form the backbone of a healthy credit profile. Establishing reminders or using automated payment options can help ensure that no due date slips through the cracks. Reducing high balances on credit cards will also benefit your score significantly. Try to keep utilization below 30% of your available limit for best results.…

Finally, check your credit score before applying for a debt consolidation loan. This will help you determine if you qualify and what kind of interest rate you might receive. Additionally, some lenders may offer better terms or rates to those with higher credit scores, so this is something to keep in mind.

Finally, check your credit score before applying for a debt consolidation loan. This will help you determine if you qualify and what kind of interest rate you might receive. Additionally, some lenders may offer better terms or rates to those with higher credit scores, so this is something to keep in mind.

While budgeting and insurance are essential, you should also make sure your money works. One way to do this is to invest in a suitable investment. It may seem like a daunting task, but plenty of resources are available to help you make the best decision for your money. Many millennials prefer Bitcoin or other crypto coins as their investment, but gold and real estate are still solid options. You can also consult with a financial advisor to determine what investment is best for you.

While budgeting and insurance are essential, you should also make sure your money works. One way to do this is to invest in a suitable investment. It may seem like a daunting task, but plenty of resources are available to help you make the best decision for your money. Many millennials prefer Bitcoin or other crypto coins as their investment, but gold and real estate are still solid options. You can also consult with a financial advisor to determine what investment is best for you. Last but not least, you should always make sure to put some money into savings. It will help you in case of an unexpected expense or emergency. You may also consider using a portion of your savings to invest in something like a home or retirement fund. Whatever you do, make sure that you have a plan for your savings to make the most of your money.

Last but not least, you should always make sure to put some money into savings. It will help you in case of an unexpected expense or emergency. You may also consider using a portion of your savings to invest in something like a home or retirement fund. Whatever you do, make sure that you have a plan for your savings to make the most of your money.

The first thing that professional credit repair services will do is review your credit reports for any derogatory marks. These are items on your credit report that can lower your scores, such as late payments, collections, charge-offs, and more.

The first thing that professional credit repair services will do is review your credit reports for any derogatory marks. These are items on your credit report that can lower your scores, such as late payments, collections, charge-offs, and more. If you have debt collectors calling you, it can be very stressful. Professional credit repair services will send ceasing letters to them on your behalf. It is a formal notice that tells them to stop contacting you. Once they receive the letter, they cannot call you again. It can give you some peace of mind and help improve your credit score.

If you have debt collectors calling you, it can be very stressful. Professional credit repair services will send ceasing letters to them on your behalf. It is a formal notice that tells them to stop contacting you. Once they receive the letter, they cannot call you again. It can give you some peace of mind and help improve your credit score.

When choosing a company, the first thing you should look for is its history. If they've been around for more than five years, they're likely not going anymore soon!

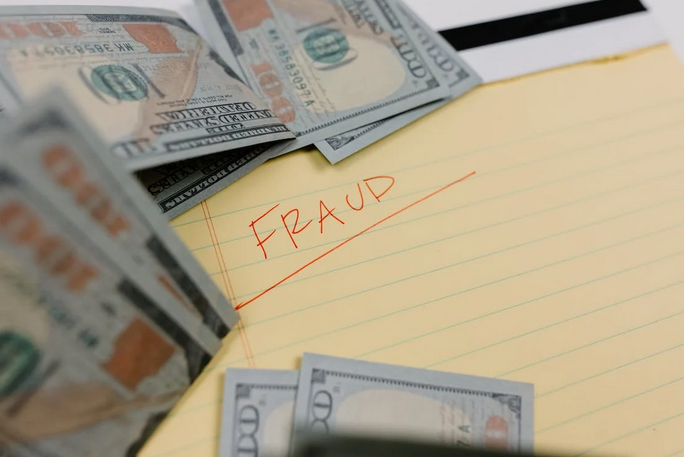

When choosing a company, the first thing you should look for is its history. If they've been around for more than five years, they're likely not going anymore soon! Not all debt consolidation companies are created equal, and some may be outright scams. So it's essential to do your research before trusting anyone with your financial future.

Not all debt consolidation companies are created equal, and some may be outright scams. So it's essential to do your research before trusting anyone with your financial future. Another vital thing to consider when choosing a debt consolidation company is its fees. Some may have a one-time fee, while others may charge monthly or annual fees. Make sure you understand these and how they will impact your overall costs.

Another vital thing to consider when choosing a debt consolidation company is its fees. Some may have a one-time fee, while others may charge monthly or annual fees. Make sure you understand these and how they will impact your overall costs.